The Bruhat Bengaluru Mahanagara Palike (BBMP) has introduced a streamlined process under the One-Time Settlement (OTS) Scheme for property owners who do not have a Self-Assessment System (SAS) application number.

This initiative allows property owners to file their property tax returns manually and benefit from exemptions or reduced penalties as per Section 152 of the BBMP Act 2020.

Below is a detailed guide to help property owners navigate the manual filing process.

BBMP OTS Scheme Manual Filing Process for Properties Without SAS Numbers

1. Verify Eligibility

Before proceeding, ensure that your property qualifies for exemption under Section 152 of the BBMP Act 2020. Commonly exempted properties include:

- Educational institutions.

- Charitable organizations.

- Other properties recognized as exempted under BBMP guidelines.

2. Collect Required Documents

Prepare the following documents to support your claim:

- Proof of ownership (sale deed, khata certificate, or similar).

- Recognition documents (e.g., government/BBMP approval for educational institutions).

- Conversion certificates (if applicable, e.g., agricultural land converted to non-residential use).

- Previous tax payment receipts (if any).

3. Obtain and Fill Form 6

- Download Form 6 from the BBMP website or collect it from your local BBMP office.

- Fill out Form 6 manually with accurate details about your property, including:

- Property location and dimensions.

- Built-up area and usage type (e.g., educational, commercial).

- Start year of operation and exemption claim details.

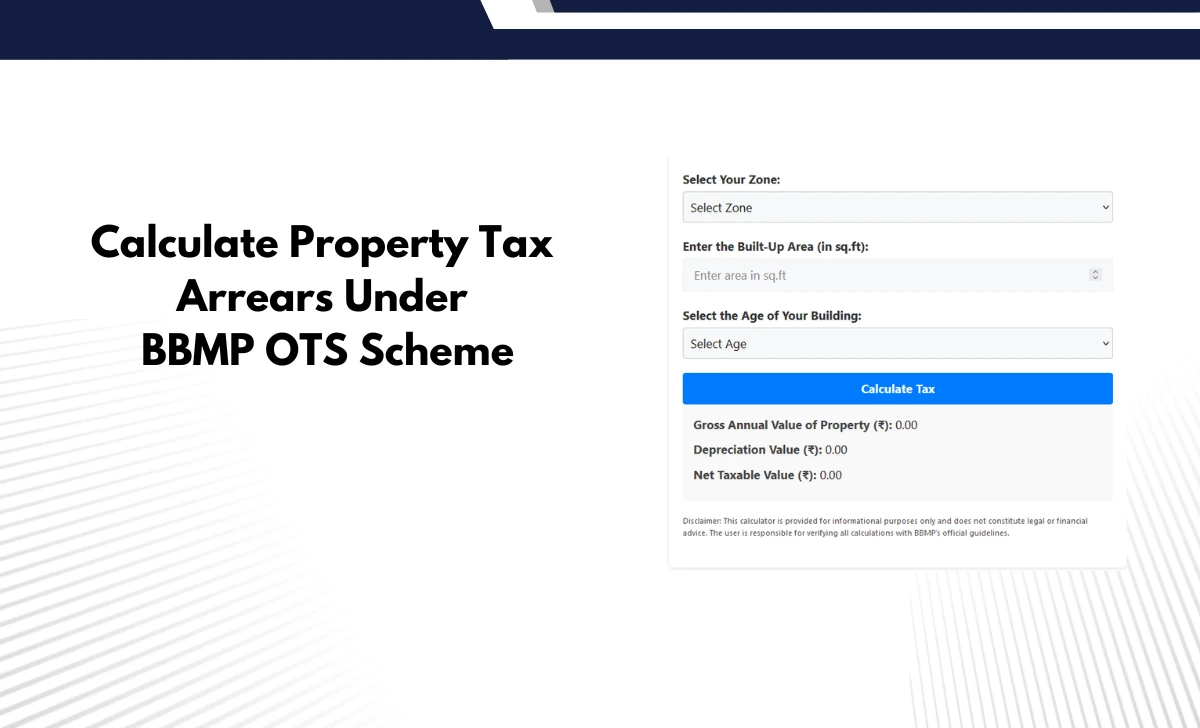

4. Calculate Property Tax

Perform and calculate self-assessment of your property tax dues using the following guidelines:

- Use the applicable rates from the SAS Notification of 2008 or SAS Notification of 2016.

- Calculate service charges if your property qualifies for an exemption (e.g., educational institutions pay service charges at ₹6.25/sq.ft in Zone B as per SAS Notification of 2016).

- Include cess amounts:

- 24% cess for years before 2021-22.

- 26% cess for years from 2021-22 onwards.

- Add penalties (if applicable) at 50% reduced rates under the OTS scheme.

Example Calculation:

For an educational institution with a built-up area of 1,10,000 sq.ft in Zone B:

- Service charge = ₹6.25 × 1,10,000 = ₹6,87,500/year.

- Cess (pre-2021) = ₹6,87,500 × 24% = ₹1,65,000/year.

- Total payable = Service charge + cess.

Repeat this calculation for each year of arrears.

5. Attach Supporting Documents

Attach all required documents to Form 6, including:

- Ownership proof.

- Recognition certificates.

- Demand drafts for payment.

6. Submit Form and Payment

Submit your completed BBMP Form 6 along with supporting documents and demand drafts to the Joint Commissioner of your zone. Ensure you:

- Obtain an acknowledgment receipt with the date of submission.

- Retain copies of all submitted documents for future reference.

Key Points to Remember during BBMP OTS Scheme Manual Filing Process

- Self-Declaration Responsibility: Filing Form 6 is treated as a self-declaration by the property owner. The BBMP reserves the right to verify and revise returns if inaccuracies are found.

- Demand Draft Payments: Payments must be made via demand draft in favor of the Chief Commissioner, BBMP, payable at Bengaluru.

- Non-SAS Properties: This process is specifically designed for properties that do not have an SAS application number or are not listed in BBMP’s online system.

- No Refunds for Non-Exempted Payments: If property tax was previously paid under a non-exempted category, it will not be refunded or adjusted.

Illustrative Example

A private educational institution constructed in 2014 but not registered in the SAS system can follow these steps:

- Calculate dues from the year of operation (e.g., service charges at ₹4.50/sq.ft as per SAS Notification of 2008 for Zone C).

- Attach recognition documents proving exemption eligibility.

- Submit Form 6 manually with relevant calculations and demand drafts.

This guide is based on BBMP Circular Number SC(R) PR/135/2023-24 dated December 26, 2023, and its revised version dated July 12, 2024. Property owners are advised to consult official notifications or seek professional assistance for accurate filing.

By following this manual filing process under BBMP’s OTS scheme, property owners without SAS numbers can settle their tax arrears efficiently while benefiting from exemptions and waivers provided by the scheme.