Managing property tax payments is a vital responsibility for property owners in Bengaluru with new BBMP challan print option for offline payments.

The Bruhat Bengaluru Mahanagara Palike (BBMP) has streamlined the process, allowing taxpayers to generate, download, and print BBMP challans online.

This guide provides a detailed walkthrough of the process and addresses all scenarios for property tax management.

How to Download and Print BBMP Challan

To download the BBMP challan for property tax payment, follow these steps:

- Visit the Official BBMP Property Tax Portal

- Go to the BBMP property tax website: bbmptax.karnataka.gov.in.

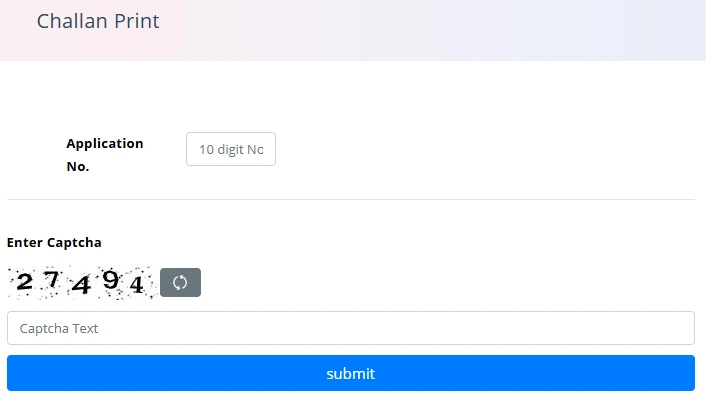

- Access the Challan Section

- On the homepage, navigate to the “Downloads” section or directly click on “Challan Print.”

- Enter Required Details

- Input your 10-digit Application Number or PID (Property Identification Number).

- Enter the captcha code displayed on the screen.

- Submit and Generate Challan

- Click on Submit. The system will display your property details and generate the challan.

- Download and Print

- Once the challan is generated, you can download BBMP challan print PDF and print it for offline payment at authorized banks or centers.

BBMP Challan Print Online

- Open the website https://bbmp.gov.in/home

- Click Property Tax

- Tap on Download Challan

- Enter your 10 digit application > hit enter

- Find the due challan and click to download

- Print the required if needed

- Click on Pay and complete the payment.

Key Information Needed

- Application Number or PID: Essential to retrieve your property details from the BBMP database.

- Assessment Year: Ensure you select the correct year for which you are generating the challan.

Payment Options

- Use the printed challan for offline payments at designated banks like Canara Bank within BBMP limits.

- Alternatively, pay online via net banking, debit/credit cards, or UPI using the BBMP portal.

Scenarios Requiring BBMP Challan Printing

- First-Time Tax Payments: New property owners must generate a challan using their application number or PID to make their first payment.

- Arrears Payment: If you have outstanding taxes from previous years, generate separate challans for each year.

- Lost Challans: If you lose your original challan, regenerate it through the portal.

- Offline Payments: For payments at banks or Bangalore One Centers, a printed BBMP challan is mandatory.

Troubleshooting Common Issues of BBMP Challan Printing

- Challan Not Generating?

- Verify that you’ve entered a valid PID or application number.

- Ensure your browser supports the portal (use updated Chrome or Firefox).

- Payment Status Not Updated?

- Wait 24 hours after payment before checking the status online.

- Contact BBMP support if discrepancies persist.

- Forgot PID/Application Number?

- Use the “Know Your BBMP PID” feature on the portal by entering details like ward number and owner name.

The ability to generate and print BBMP challan online simplifies tax payments and supports timely civic infrastructure development in Bengaluru, Always keep your printed documents safe for future use.