The Karnataka government has announced a significant policy shift by extending the B Khata system across the state. This initiative aims to regularize unauthorized properties and increase municipal tax collections, with a focus on strengthening urban infrastructure and governance.

What is Karnataka B Khata System?

The B Khata system is a property registration mechanism used for unauthorized or irregular properties. Unlike A Khatas, which certify legal compliance with building norms, B Khatas serve as a temporary record for properties that do not meet these standards.

While these properties cannot be sold or mortgaged easily, they are now being taxed under this system to generate revenue for Urban Local Bodies (ULBs).

Why Extend B Khata System Statewide?

- Revenue Growth:

- Karnataka has approximately 55 lakh urban properties, of which only 22 lakh have A Khatas.

- The remaining unauthorized properties will now be taxed under the B Khata system, potentially adding ₹3,500 crore annually to municipal revenues.

- Support for Infrastructure Development:

- The additional funds will be allocated to improve civic amenities such as roads, drainage systems, and public utilities.

- This move also aims to make ULBs more self-reliant, reducing their dependence on state grants.

- Addressing Legal Challenges:

- Previous efforts to regularize unauthorized properties, such as the Akrama-Sakrama scheme, faced legal roadblocks.

- The B Khata system offers a temporary solution until comprehensive regularization policies are implemented.

Implementation Timeline

The government began issuing B Khatas on February 10, 2025, with a strict three-month timeline for completion. Deputy Commissioners across districts have been instructed to:

- Issue B Khatas for unauthorized properties.

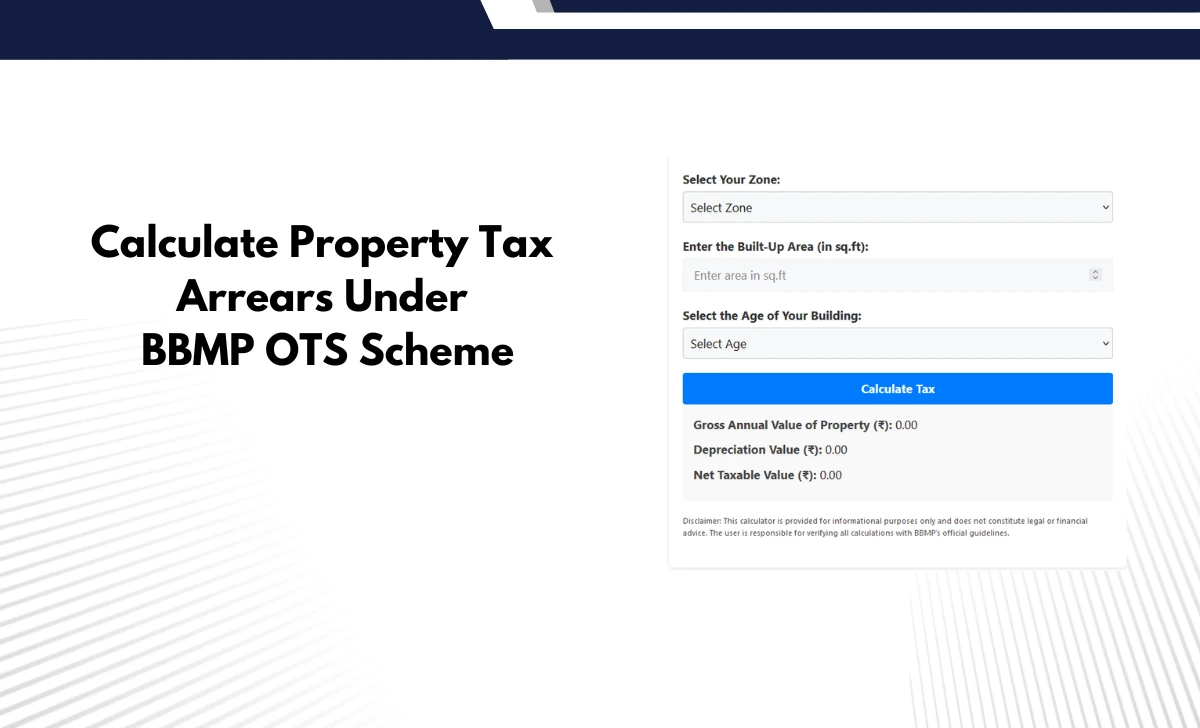

- Recover pending property taxes through a one-time settlement scheme.

This campaign is expected to bring over 30 lakh unauthorized properties into the tax net.

Benefits of B Khata system for property owners

- Increased Tax Compliance:

- By bringing unauthorized properties under taxation, the government ensures broader compliance and equitable revenue generation.

- Improved Urban Governance:

- Strengthening local governance through self-reliant ULBs will lead to better management of urban areas.

- Timely property tax collection will enable ULBs to plan and execute development projects more effectively.

- Enhanced Property Value:

- Regularizing unauthorized properties indirectly increases their market value, benefiting property owners in the long term.

Challenges and Stakeholder Concerns

- Transparency in Fund Allocation:

- Real estate leaders have urged the government to ensure that collected taxes are used transparently for infrastructure development in areas covered under the B Khata system.

- Full Regularization Pending:

- While the B Khata system addresses taxation, it does not grant full legal status to unauthorized properties. Property owners may still face restrictions on selling or mortgaging their assets.

- Missed Central Grants:

- Delays in holding elections for ULBs have cost Karnataka approximately ₹2,800 crore in central government grants. Conducting timely elections is crucial for accessing these funds.

Impact of B Khata on Municipal Tax Collections

The government has indicated that this is a step toward eventual full regularization of unauthorized properties.

Initiatives like converting B Khatas into A Khatas through betterment charges and introducing digital platforms like Karnataka eKhata are expected to streamline property management further.

Karnataka’s decision to extend the B Khata system statewide marks a pivotal moment in urban governance and infrastructure development.

By leveraging this policy, the state aims to address long-standing issues with unauthorized properties while significantly boosting its municipal tax revenue. However, B Khata property tax success will depend on effective implementation and transparent utilization of funds.