The Bruhat Bengaluru Mahanagara Palike (BBMP) introduced the One-Time Settlement (OTS) Scheme to help property owners clear outstanding property tax arrears with significant benefits, such as interest waivers and reduced penalties.

To ensure compliance and take advantage of this scheme, it is essential to understand the key deadlines, circulars, and procedures outlined by BBMP.

This article provides a comprehensive overview of what you need to know.

Key Circulars Governing the OTS Scheme

- Circular Number SC(R) PR/135/2023-24 (Dated December 26, 2023):

- Introduced the OTS scheme with a simplified process for filing property tax returns.

- Allowed property owners in exempted categories (as per Section 152 of the BBMP Act 2020) to file self-assessment returns.

- Emphasized the “pay-first-verify-later” approach to expedite payment processing.

- Revised Circular Number SC(R) PR/135/2023-24 (Dated July 12, 2024):

- Updated procedures for filing returns under the exempted category.

- Provided detailed instructions for properties without SAS application numbers to file manually.

- Clarified cess rates and penalties applicable under the OTS scheme.

These circulars aim to maximize participation in the OTS scheme while ensuring transparency and accountability in property tax filings.

Key Deadlines for the OTS Scheme

- Initial Deadline:

- The original deadline for availing benefits under the OTS scheme was March 31, 2024.

- Extended Deadline:

- Due to overwhelming responses and procedural delays, BBMP extended the deadline to July 31, 2024, as per the revised circular issued on July 12, 2024.

- Final Deadline:

- The final opportunity to settle dues under the OTS scheme was announced as December 31, 2024, with no further extensions planned.

Property owners are strongly advised to adhere to these deadlines to avoid penalties and loss of benefits under the scheme.

Simplified Filing Process Under OTS

The OTS scheme simplifies property tax filing based on specific scenarios:

- Scenario 1: Properties with SAS Numbers

- Scenario 2: Properties Without SAS Numbers

- Scenario 3: Exempted Properties

- Benefits of Meeting Deadlines

Important Notes from BBMP Circulars

- Self-Declaration Responsibility:

- Filing a return under the OTS scheme is treated as a self-declaration by the assessee. BBMP reserves the right to verify and revise returns if discrepancies are found.

- Cess Applicability:

- Cess rates are calculated as follows:

- 24% of property tax/service charges for years before FY 2021-22.

- 26% of property tax/service charges from FY 2021-22 onwards.

- Cess rates are calculated as follows:

- No Refunds for Non-Exempted Payments:

- Taxes paid previously under non-exempted categories will not be refunded or adjusted against current dues.

- Demand Draft Payments:

- For properties without SAS numbers or in case of online system glitches, payments can be made via demand draft payable to the Chief Commissioner, BBMP.

Steps to Ensure Compliance

- Check your property’s eligibility under Section 152 of the BBMP Act or other relevant categories.

- Gather necessary documents such as ownership proof, recognition certificates, and previous tax receipts.

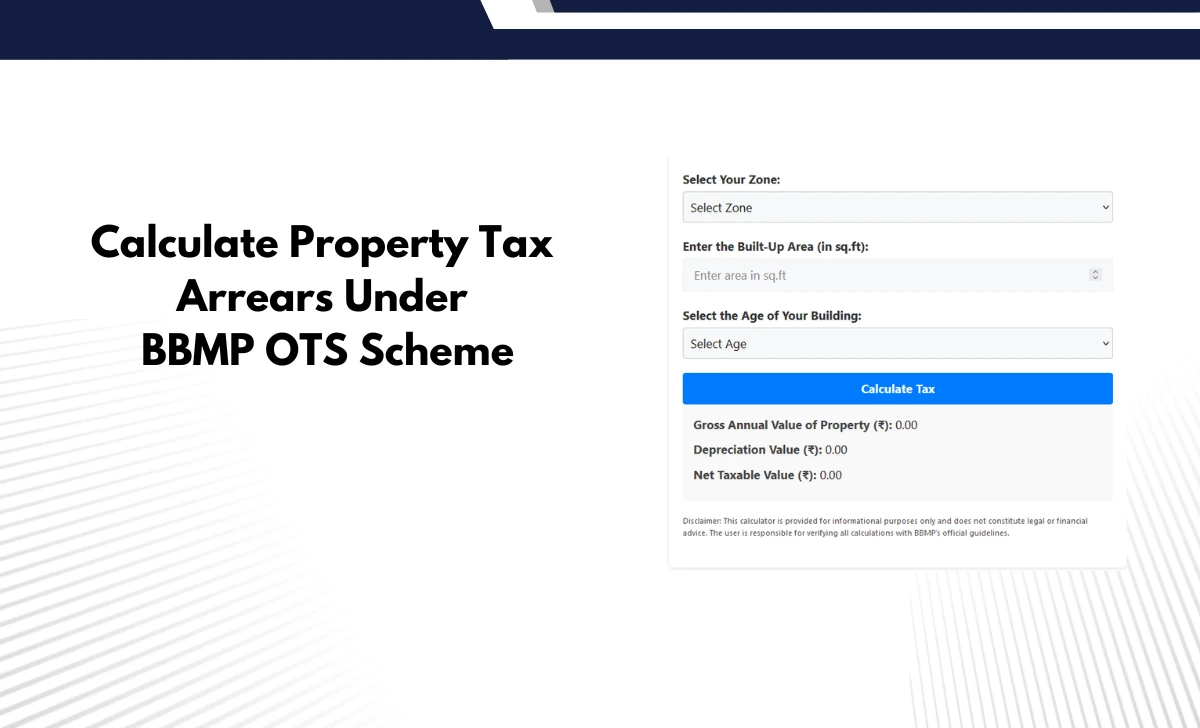

- Use BBMP online portal (bbmptax.karnataka.gov.in) or visit your zonal office for manual filing.

- Verify cess rates and calculate dues accurately using SAS Notifications of 2008 and 2016.

- Submit forms and payments before the final deadline of December 31, 2024.

The BBMP’s OTS scheme offers an excellent opportunity for property owners to clear their tax arrears while enjoying significant benefits like interest waivers and reduced penalties.

By understanding key deadlines and following procedures outlined in official circulars, you can ensure compliance and avoid unnecessary liabilities and Act promptly to take full advantage of this limited-time initiative.