The Bruhat Bengaluru Mahanagara Palike (BBMP) has introduced a simplified process under the One-Time Settlement (OTS) Scheme to help property owners clear their tax arrears efficiently.

The scheme provides various filing methods based on the type of property, its tax history, and exemption eligibility under Section 152 of the BBMP Act 2020.

Below, we explore illustrative examples and step-by-step instructions for filing OTS scheme property tax returns under different scenarios.

Scenario1: BBMP Property with an SAS Application Number but No Tax Paid for Several Years

- Property Type: Educational Institution.

- SAS Application Number: Available.

- Tax History: No payments made since 2016-17.

Filing Process:

- Year 2016-17:

- File Form 6 online under the exempted category.

- Upload supporting documents such as recognition certificates and ownership proof.

- Years 2017-18 to 2024-25:

- If no changes in property usage or built-up area, file Form 4 online for these years.

- If there are changes (e.g., increased built-up area in 2019-20), file Form 5 for the year of change and Form 4 for subsequent years.

- Ensure accurate self-assessment of service charges and cess.

- Submit all required documents to avoid discrepancies during verification.

Scenario2: BBMP Property with SAS Application Number, Previously Paid as Exempted, but No Recent Payments

- Property Type: Educational Institution.

- SAS Application Number: Available.

- Tax History: Paid until 2017-18 but no payments made afterward.

Process:

- Year 2018-19:

- File Form 6 online under the exempted category and upload recognition documents.

- Years 2020-21 to 2024-25:

- File Form 4 online if no changes in property usage or area since the last filing.

- If Changes Occurred:

- For example, if built-up area increased in 2022-23, file Form 5 for that year and Form 4 for subsequent years.

- Payments already made in previous years will not be refunded or adjusted.

- Cess calculations must align with applicable rates (24% before 2021-22; 26% from 2021-22 onwards).

Scenario3: BBMP Property Paid as Non-Exempted Previously but Now Claiming Exemption

- Property Type: Educational Institution.

- SAS Application Number: Available.

- Tax History: Paid as a non-exempted property until 2015-16.

Process:

- File Form 6 online for the first unpaid year (e.g., 2016-17) under the exempted category.

- Upload recognition documents proving eligibility for exemption under Section 152 of the BBMP Act.

- For subsequent years, file Form 4 if there are no changes or Form 5 if there are changes in usage or built-up area.

- Taxes paid previously as non-exempted will not be refunded or adjusted.

- Ensure all arrears are cleared to avail of OTS benefits.

Scenario4: BBMP Property Without a SAS Application Number

Property Type: Educational Institution constructed in 2014 but never registered in BBMP’s SAS system.

Filing Process:

- Prepare a manual self-assessment using Form 6 for each year since the start of operations (e.g., from FY 2015-16).

- Attach supporting documents such as ownership proof, recognition certificates, and conversion certificates (if applicable).

- Submit all documents along with demand drafts for payment to the Joint Commissioner of your zone.

- Obtain an acknowledgment receipt from BBMP upon submission.

- This process is treated as a self-declaration by the property owner, subject to BBMP’s verification.

- Delays in creating an SAS application number should not prevent filing under OTS.

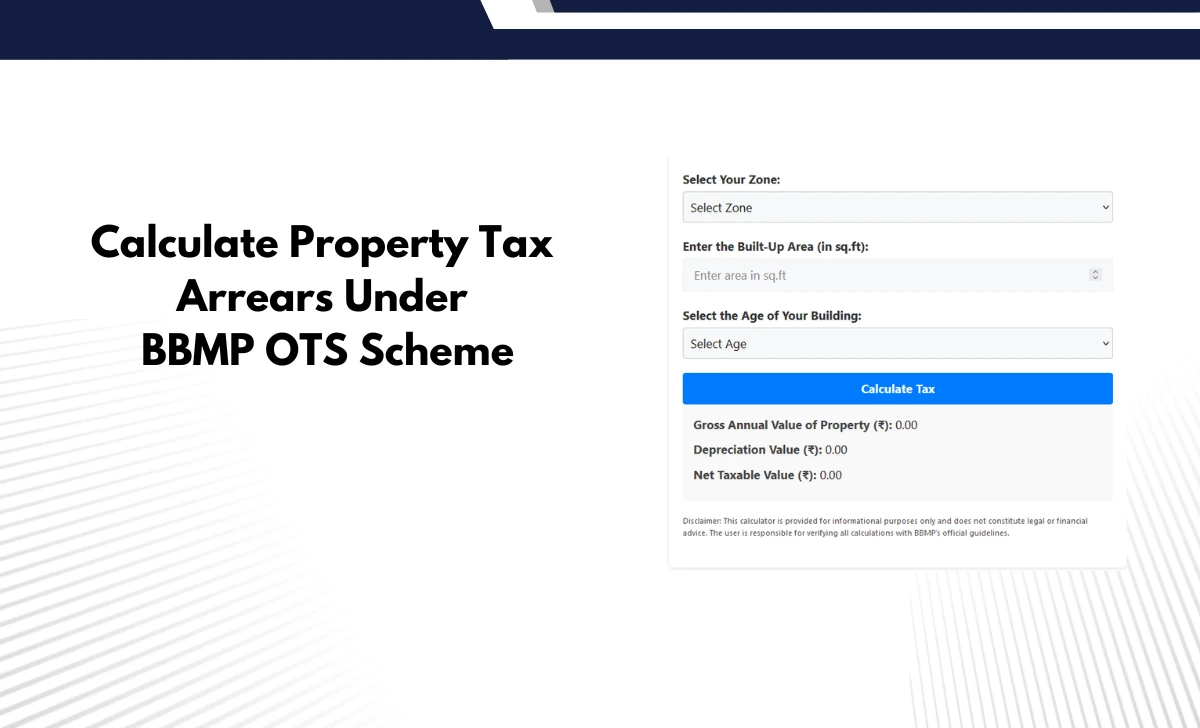

Illustrative Example for Manual Filing

- Land Area: Originally agricultural land converted to non-residential use in FY 2013-14.

- Built-Up Area:

- Educational purpose: 1,10,000 sq.ft (recognized in FY 2015-16).

- Commercial purpose (shopping complex): 20,000 sq.ft.

Tax Calculation Summary:

- FYs Before Recognition (2013–15):

- Pay applicable rates for vacant land and unoccupied commercial space as per SAS Notification of 2008.

- FYs After Recognition (2015–16):

- Educational space taxed at service charge rates (e.g., ₹4.50/sq.ft for Zone C).

- Commercial space taxed at tenanted property rates (e.g., ₹10/sq.ft for Zone C).

- From FY 2016–17 Onwards:

- Apply new rates from SAS Notification of 2016 (e.g., ₹6.25/sq.ft for educational space in Zone B).

- Calculate cess at applicable rates (24% until FY 2020–21; 26% from FYs after).

General Notes:

- The OTS scheme waives interest on arrears and reduces penalties by up to 50%.

- All filings are treated as self-assessments, with full responsibility on the assessees to ensure accuracy.

- BBMP reserves the right to verify and revise returns if discrepancies are found during audits.

By following these illustrative examples based on specific scenarios, property owners can efficiently file their tax returns under BBMP OTS scheme while availing of its benefits.