The Bruhat Bengaluru Mahanagara Palike (BBMP) introduced the One-Time Settlement (OTS) Scheme to help property owners clear their tax arrears with significant benefits, including waivers on interest and reduced penalties.

BBMP OTS Scheme calculator may calculates the property tax arrears under this scheme to apply BBMP OTS which involves understanding the applicable rates, CESS, penalties, and exemptions.

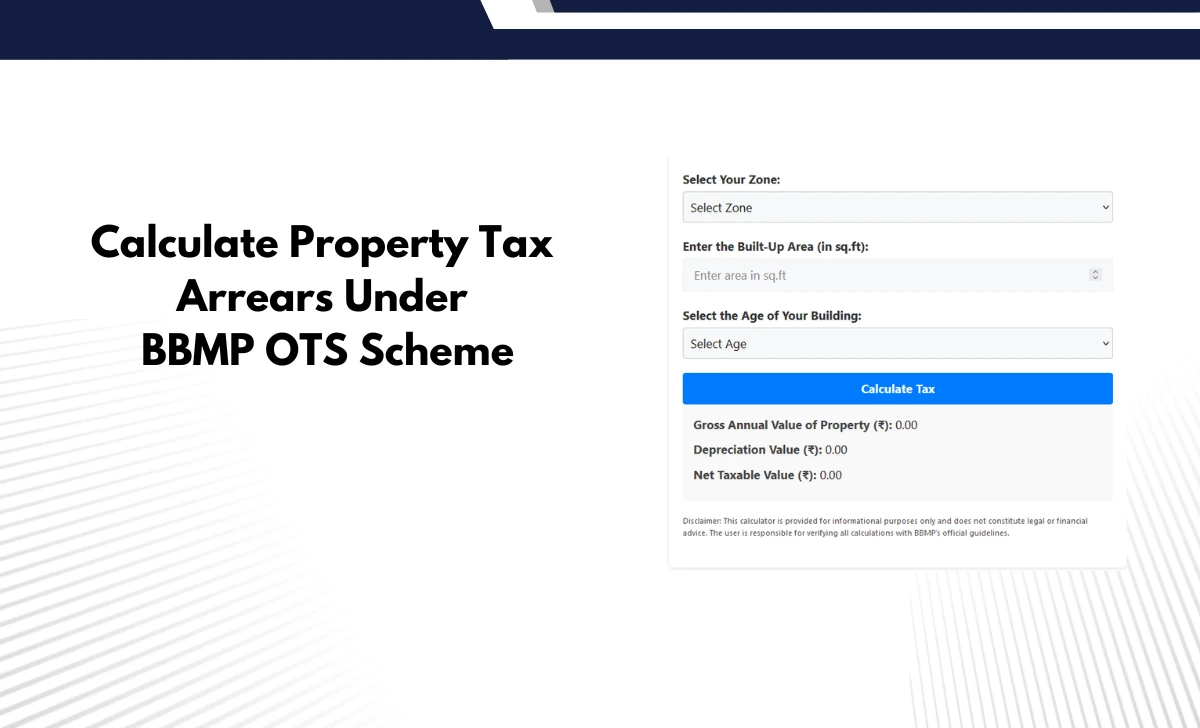

BBMP OTS Scheme Calculator for Residential Property

Provide Zone, Built-up Area, and Building Age to calculate your property tax.Disclaimer: This calculator is provided for informational purposes only and does not constitute legal or financial advice. The user is responsible for verifying all calculations with BBMP’s official guidelines.

How to Calculate BBMP Property Tax Arrears Under OTS Scheme

Below is a step-by-step guide to calculating your property tax dues under the OTS scheme.

Step 1: Understand the Components of Property Tax

Property tax under BBMP is calculated using the following formula:

Property Tax K =(G−I)×20%+ Cess

Where:

- G= Gross Unit Area Value (based on property usage, location, and area).

- I = Depreciation (G×D/100, where D is the depreciation rate).

- Cess = 24% of the property tax for years before 2021-22 and 26% for 2021-22 onwards.

Step 2: Identify Applicable Rates

- Determine the Zone and Category:

- BBMP divides properties into zones (A to F) based on guidance value.

- Categories such as residential, commercial, tenanted, or exempted determine the applicable rates.

- Refer to SAS Notifications:

- Use BBMP’s SAS Notifications (2008 and 2016) to find applicable rates for your property’s category and zone.

Step 3: Calculate Tax for Each Year

- Base Property Tax:

Multiply the built-up area by the applicable rate per square foot for that year. Adjust for depreciation if applicable. - Add Cess:

- For years before 2021-22, cess is 24% of the property tax.

- For years from 2021-22 onwards, cess is 26%.

- Penalties and Interest:

- Under the OTS scheme, penalties are reduced by 50%, and interest on arrears is waived.

Step 4: Apply Exemptions

If your property qualifies under Section 152 of the BBMP Act 2020 (e.g., educational institutions), calculate service charges instead of full property tax:

- Service charge = Applicable Rate×Built up Area.

Step 5: Use Illustrative Examples

Here’s an example calculation based on a hypothetical educational institution:

Example Property Details:

- Built-up area: 1,10,000 sq. ft. (educational purpose).

- Zone: B.

- Applicable rate: 6.25/sq. ft. (as per SAS Notification 2016).

Calculation for a Single Year (e.g., 2016-17):

- Base Property Tax in Rs = 1,10,000×6.25=6,87,5001,

- Cess in Rs. = 6,87,500×24%=1,65,000

- Total Tax Payable in Rs = 6,87,500+1,65,000=8,52,500

For multiple years, repeat this process while adjusting for changes in rates or cess percentages.

Step 6: Use BBMP’s Online Tools

BBMP provides an online calculator to simplify tax computations, Input your property details (zone, category, built-up area) to get an accurate estimate.

Key Benefits of OTS Scheme

- Interest Waiver: No interest on delayed payments.

- Reduced Penalties: Penalty reduced by up to 50%.

- Simplified Filing: Self-assessment allowed with verification by BBMP later.

Important Notes

- Ensure compliance with deadlines to avail OTS benefits.

- Retain all payment receipts and supporting documents for verification.

- If your property is not listed in BBMP SAS system or lacks a PID number, you may need to file manually using Form VI.

By following these steps and leveraging BBMP resources like SAS notifications and online tools, you can calculate your property tax arrears accurately under the OTS scheme while maximizing available benefits