The BBMP OTS scheme self-assessment process for exempted properties provides a streamlined mechanism for property owners to settle tax arrears and claim exemptions.

This process, governed by the Bruhat Bengaluru Mahanagara Palike (BBMP), simplifies the filing of property tax returns under the One-Time Settlement (OTS) Scheme.

With recent revisions to the guidelines in July 2024, the process has become more efficient, enabling citizens to file self-assessments upfront with verification conducted later by BBMP officials.

Eligibility for Property Tax Exemption Under BBMP OTS Scheme

To qualify for exemption under Section 152 of the BBMP Act, 2020, properties must meet specific criteria. Commonly exempted properties include:

- Religious institutions

- Charitable trusts

- Educational institutions recognized by the government

- Government-owned properties

Even exempted properties are required to pay service charges for municipal services, calculated based on property usage.

Self-Assessment Filing Using Forms 4, 5, and 6

Form 6

- Purpose: Used for the first year of filing under the exempted category or when the property is newly assessed.

- Steps:

- Log in to the BBMP property tax portal using your Property Identification Number (PID) or SAS Application Number.

- Select “BBMP Form 6” and provide details such as property type, built-up area, and exemption category.

- Upload supporting documents like ownership proof and exemption certificates.

- Submit the form and pay applicable service charges.

Form 4

- Purpose: Used for subsequent years if there are no changes in property details.

- Steps:

- Access the BBMP portal and select “Form 4.”

- Confirm that no changes have occurred in property use or size since the previous assessment.

- Pay service charges for each unpaid year.

Form 5

- Purpose: Used when there are changes in property details, such as usage or built-up area.

- Steps:

- Log in to the BBMP portal and select “Form 5.”

- Update details reflecting changes in property usage or dimensions.

- Upload revised documents and pay service charges accordingly.

Steps to File Self-Assessment for BBMP Exempted Properties

- Gather Necessary Documents

- Collect ownership proof, exemption certificates (e.g., trust deeds), and previous tax receipts (if applicable).

- Obtain Form VI

- This form is mandatory for filing under the BBMP one-time settlement scheme for tax-exempt properties.

- Access BBMP Portal or Visit Ward Office

- Log in online using your PID/SAS number or visit your ward office if you lack these details.

- Complete and Submit Forms (4/5/6)

- Fill out Form VI for new assessments, Form IV for unchanged details, or Form V for updated property information.

- Pay Service Charges

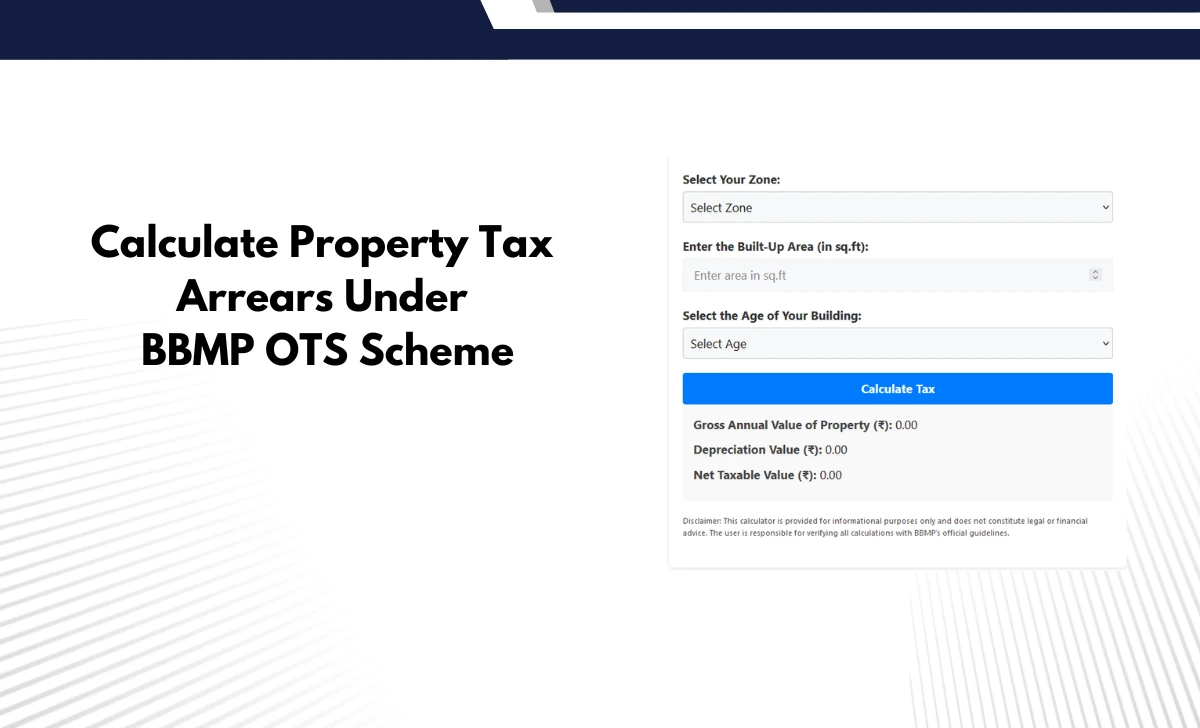

- Calculate applicable service charges based on tax rates and submit BBMP payment online or via demand draft.

- Verification & Acknowledgment

- Receive BBMP acknowledgment receipt upon submission, BBMP will verify your return later.

- Track Application Status

- Monitor your application status online to ensure approval.

Illustrative Examples of Filing Scenarios

- If a property has an SAS Application Number but hasn’t paid taxes since a specific year:

- Use Form VI online for the first unpaid year.

- Use Form IV for subsequent years if no changes occurred or Form V if there were modifications.

- If a property does not have an SAS Application Number:

- File manually using Form VI with supporting documents like ownership proof and exemption eligibility certificates.

- For properties transitioning from non-exempt to exempt categories:

- File using Form VI with updated usage details and exemption documentation.