Navigating the process of BBMP Form 6 download is essential for property owners in Bengaluru seeking tax exemptions or compliance under the Bruhat Bengaluru Mahanagara Palike (BBMP) regulations.

This form is particularly relevant for properties exempted from property tax but liable for service charges under Section 152 of the BBMP Act 2020.

Here’s a detailed guide covering all scenarios, ensuring you have the information needed to complete the process seamlessly.

What is BBMP Form 6?

Form 6, also referred to as Form VI, which is a self-assessment property tax return form designed for properties exempted from BBMP property tax payment but subject to service charges.

It is commonly used by owners of residential properties, educational institutions, or other eligible entities seeking exemptions under specific provisions of the BBMP Act.

Eligibility for Using BBMP Form VI

The following categories of property owners can apply using BBMP Form VI:

- Properties used for residential purposes, such as orphanages, old-age homes, or student hostels of recognized institutions.

- Properties exempted from property tax but liable for service charges under Section 152 of the BBMP Act.

- Ex-servicemen owning self-occupied residential properties, eligible for reduced service charges.

- Non-residential properties claiming partial exemptions based on specific usage criteria.

Steps to Download and Submit BBMP Form 6

- Access the Official Website

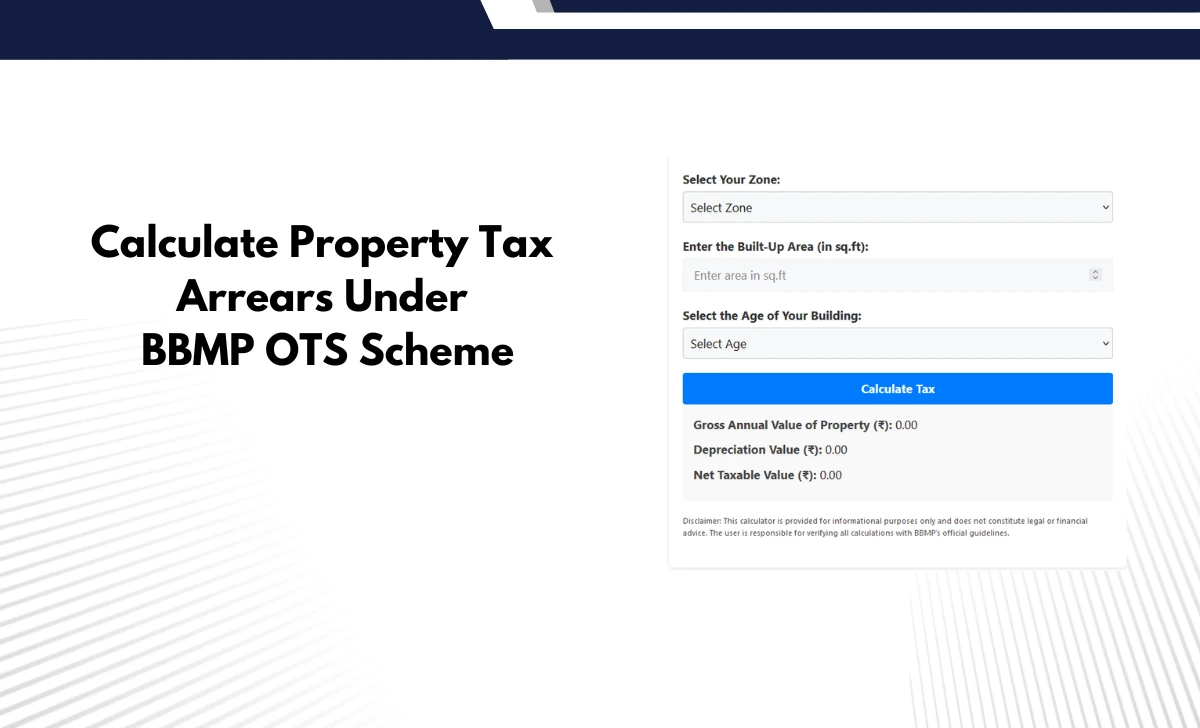

- Visit the official BBMP Property Tax System portal to locate and download BBMP Form VI from the source documents/Form6OTS

- Ensure you select the correct form applicable to your exemption type.

- Fill in General Information

- Provide details such as property identification number (PID), owner’s name, address, and usage type (residential or non-residential).

- Specify Property Details

- Include built-up area, site dimensions, number of floors, and year of construction. Mention any portions used for commercial purposes separately.

- Attach Supporting Documents

- Submit proof of exemption eligibility, such as certificates from recognized institutions or documents confirming residential use.

- Submit Online or Offline

- While most applications can be submitted online, you may also submit a hard copy at the nearest BBMP office if required.

Downloading and submitting BBMP Form 6 is a critical step for property owners seeking tax exemptions while complying with service charge requirements under Section 152 of the BBMP Act 2020.

Ensure you follow all steps meticulously and provide accurate details to avoid penalties or delays in processing your application.

Whether you are an ex-serviceman, an institution owner, or managing a mixed-use property, this guide ensures you are well-equipped to handle all scenarios effectively with BBMP Form VI.