The BBMP property tax due date is an important timeline for property owners in Bangalore. Timely payment ensures compliance with municipal laws and contributes to the city’s infrastructure development.

BBMP Property Tax Late Payment Penalty Calculator

This guide provides a detailed overview of the BBMP property tax payment deadline, rebates, penalties, and key dates for FY 2024-25. Additionally, it includes links to resources for calculating your tax and understanding the payment process.

Key Dates for BBMP Property Tax Payment in FY 2024-25

- Rebate Period:

- A 5% rebate is available for full payments made between April 1, 2024, and July 31, 2024.

- This extension was granted due to the Lok Sabha elections and public holidays in April.

- First Half Interest Start Date:

- If the first installment is not paid by July 31, 2024, interest at 2% per month begins accruing from August 1, 2024.

- Second Half Interest Start Date:

- For those opting to pay in two installments, interest on the second half begins if payment is delayed beyond November 29, 2024.

- Penalty Start Date:

- Penalties on overdue payments begin from November 29, 2024, in addition to monthly interest charges.

- Final Payment Deadline:

- Property taxes must be paid by March 31, 2025, to avoid further legal actions or property attachment.

For a detailed explanation of how BBMP calculates property tax using the Unit Area Value (UAV) system, visit BBMP Property Tax Calculator & Formula UAV.

BBMP Property Tax Rebate Eligibility

To encourage early payments:

- Pay the full tax amount in one installment before July 31, 2024, to avail a 5% rebate.

- This rebate applies to all eligible residential and commercial properties.

Note: Payments made after July 31 or in two installments will not qualify for the rebate.

Penalty and Interest for Late BBMP Property Tax Payment

- Interest Charges:

- A monthly interest of 2% on overdue amounts applies starting from:

- August 1, 2024 (first installment delay).

- November 30, 2024 (second installment delay).

- A monthly interest of 2% on overdue amounts applies starting from:

- Penalty Charges:

- Penalties are imposed starting from November 29, 2024, on top of the interest charges.

- Long-term defaulters (over five years) benefit from capped penalties under the BBMP Amendment Act of 2024.

Second Installment Penalty-Free Clause

If you choose to pay your BBMP property tax in two installments:

- The second installment must be paid by November 29, 2024, to avoid penalties.

- However, payments made in two installments do not qualify for the 5% rebate, which is reserved for taxpayers who pay their entire tax liability in one go before July 31.

For a step-by-step guide on making your payments online or offline and understanding rebates better, visit BBMP Property Tax Payment Process & Rebates.

Offline payments can also be made at authorized banks or BBMP help centers.

Tax-Free Exemptions for Certain Properties

Under the BBMP Amendment Act of 2024, specific properties are exempt from penalties or taxes:

- Buildings Up to 1,000 Square Feet:

- Properties with a built-up area of up to 1,000 sq. ft., used exclusively for self-occupation, are exempt from property tax penalties.

- This exemption does not apply to rented or commercial properties.

- Government Residential Buildings:

- All government-owned residential buildings are exempt from property tax penalties.

- Slum Properties:

- Properties located in recognized slums or those built by the government for economically weaker sections (e.g., houses under 300 sq. ft.) are fully exempt from both property tax and penalties.

- Interest Waiver for Long-Term Defaulters:

- Interest on overdue taxes exceeding five years has been waived under the new law.

Additional Insights on BBMP Tax for FY 2024-25

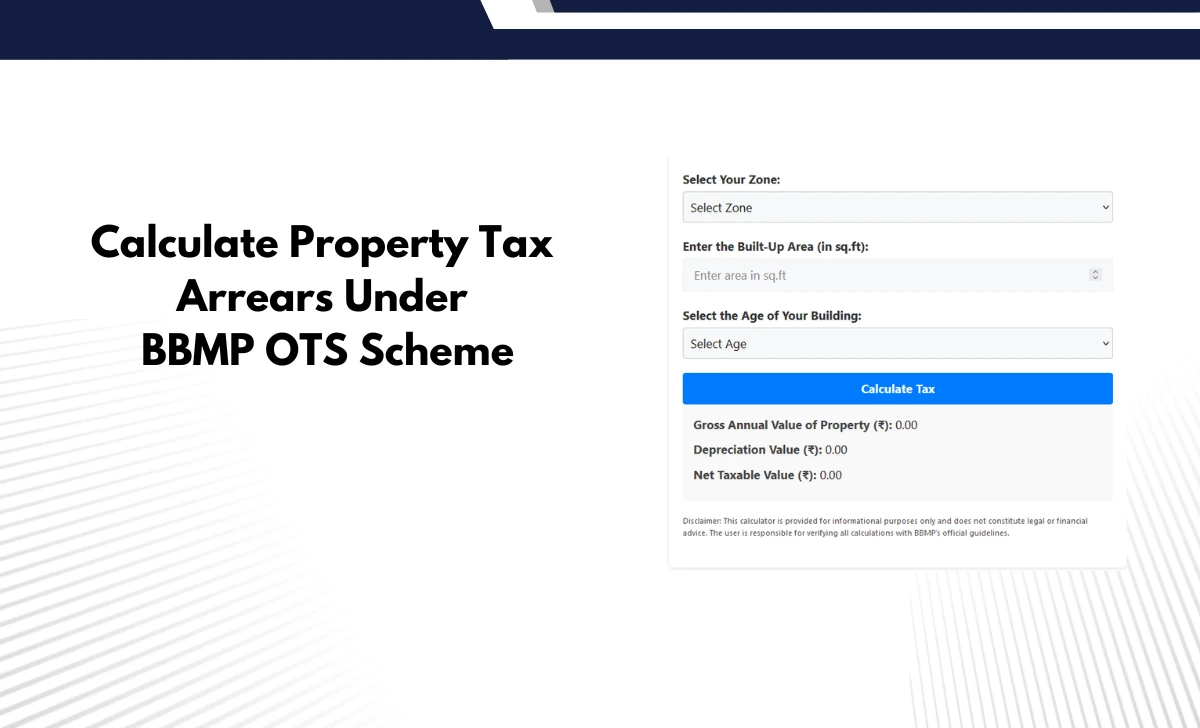

- One-Time Settlement Scheme:

- A one-time settlement scheme allows waivers on interest and nominal penalties for overdue taxes if paid by November 30, 2024.

- Refunds for Overpayments:

- Overpayments will be refunded automatically within ten working days as per BBMP’s updated process.

- Tax Rules for Properties Under Construction:

- If construction is completed before October 1, full-year tax applies.

- For properties completed after October 1, only half-year tax is applicable.