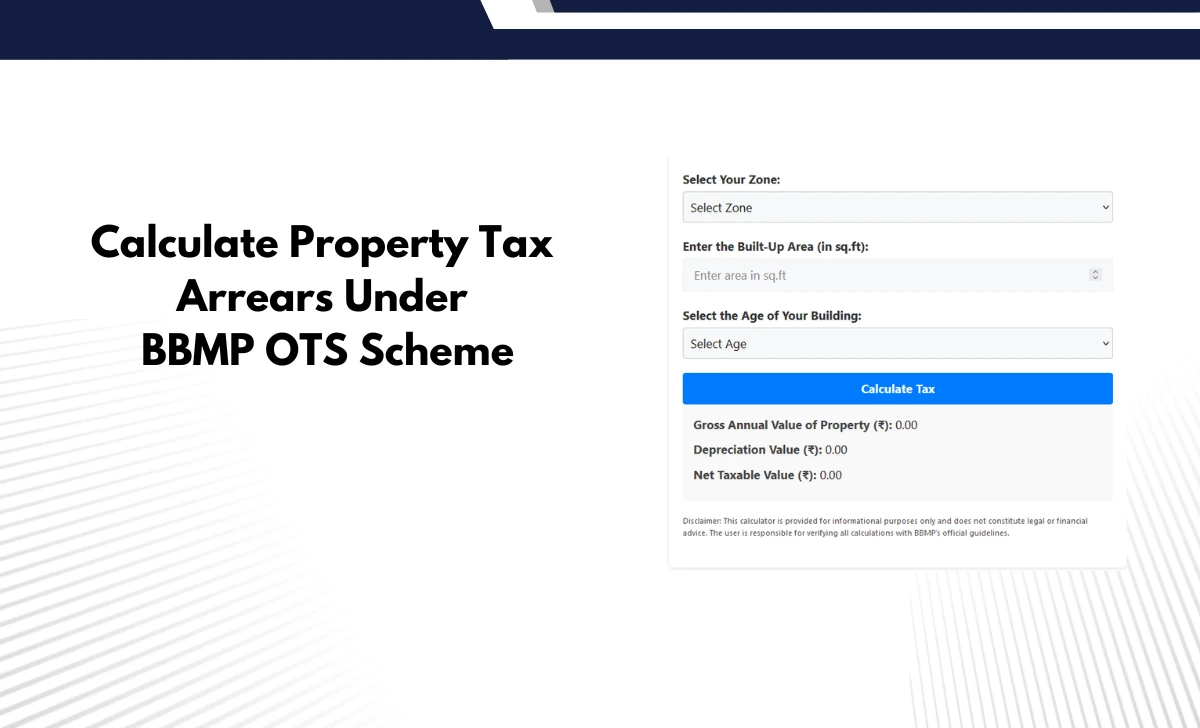

The BBMP property tax calculator is an essential tool for accurately calculating property taxes for residential and non-residential properties in Bangalore.

BBMP Tax Calculator for Residential Property

Simple Guide to BBMP Property Tax Calculation by providing Zone, Built-up area to get Depreciation Value and Due approximately for Residential Computation.

Zone Selection

Built-Up Area

Building Age

Results

*** This calculator provides an approximate property tax estimate based on the details entered. The results are for informational purposes only and should not be considered final.

It considers factors like built-up area, zoning, depreciation, and occupancy type. This guide taxarivu provides a detailed explanation of how to use the calculator effectively and understand the tax calculation formula.

How to Use BBMP Property Tax Calculator for Residential Properties

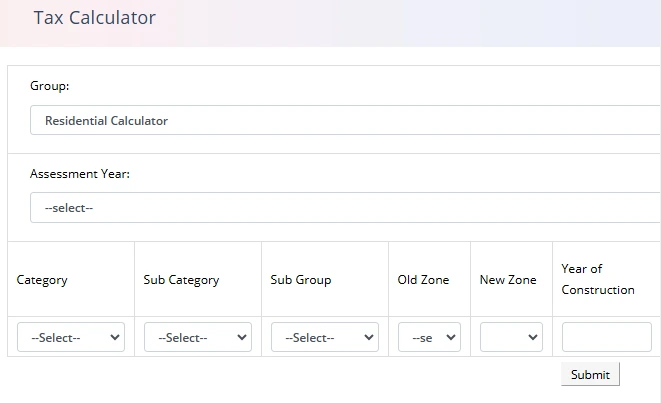

The BBMP property tax calculator from the official portal simplifies the process of determining property tax for residential properties. Follow these steps for accurate computation:

Steps to Use the BBMP Property Tax Calculator:

- Visit the Official BBMP Portal:

- Navigate to the page in bbmptax.karnataka.gov.in.

- Select Residential Calculator:

- Under the "Group" dropdown menu, choose "Residential Calculator."

- Choose the Assessment Year:

- Select the applicable assessment year (e.g., 2023-2024).

- Enter Property Details:

- Provide key details such as:

- Category: Choose from RCC/Madras Terrace, Tiled/Sheet buildings, etc.

- Sub-Category: Specify additional structural details.

- Old Zone/New Zone: Select your property's zoning classification (A to F).

- Year of Construction: Enter the year when your property was built.

- Built-Up Area: Input the total built-up area in square feet.

- Car Park Area: If applicable, enter parking area in square feet.

- Provide key details such as:

- Specify Occupancy Type:

- Indicate whether your property is "Self-Occupied" or "Tenanted."

- Calculate Tax:

- Click on "Calculate" to compute your property tax based on the entered details.

- Review and Proceed:

- Verify the calculated tax amount, including any applicable rebates or penalties.

- Proceed with online payment or generate a challan for offline submission.

This process ensures that taxpayers can compute their liabilities accurately without requiring professional assistance.

BBMP Property Tax Calculation Formula

The BBMP property tax calculation is based on the Unit Area Value (UAV) system, which considers factors such as built-up area, depreciation, and cess charges. The formula ensures transparency and fairness in tax computation.

Formula:

Bengaluru Property Tax = (Unit Area Value×Built Up Area * 10) - Depreciation Amount + Cess Charges

Key Components Explained:

- Unit Area Value (UAV):

- A fixed rate per square foot assigned based on zoning classifications (A to F). Premium zones like A and B have higher rates compared to lower zones like E or F.

- Built-Up Area:

- The total constructed area of the property in square feet.

- Depreciation Amount:

- Reduction in taxable value based on building age:

- Less than 5 years: No depreciation

- 6–10 years: 10%

- 11–20 years: 20%

- Above 20 years: 30%

- Reduction in taxable value based on building age:

- Cess Charges:

- Additional charges such as solid waste management and water supply maintenance (typically 24% of property tax).

Example Calculation:

For a residential property with a built-up area of 1,000 sq ft in Zone C (UAV = Rs. 1.80)

- Gross Annual Value = Rs. 1.80 * 1,000 * 10 = Rs. 18,000

- Depreciation (20%) = 18,000 * 0.20 = Rs. 3,600

- Taxable Value = 18,000 - 3,600 = Rs. 14,400

- Cess Charges (24%) = 14,400 * 0.24 = Rs. 3,456

- Final Property Tax = 14,400 + 3,456 = Rs. 17,856

This formula ensures accurate computation for residential properties under BBMP jurisdiction by accounting for depreciation and cess charges.

What is the 5 Percent Discount on BBMP Taxes?

BBMP offers a 5% rebate on property taxes if paid in full before the due date (usually April 30 or July 31). This incentive encourages BBMP Property tax payment timely and reduces financial burdens.

Example:

If your total tax liability is ₹20,000 and you pay before the deadline, you only need to pay ₹19,000 after availing of the rebate.

BBMP Commercial Property Tax Calculator

For commercial properties, tax calculations involve higher UAV rates and additional cess charges compared to residential properties.

Steps for Commercial Property Tax Calculation:

- Identify your property's usage category (e.g., office space or retail).

- Compute gross annual value using UAV rates specific to commercial properties.

- Deduct depreciation based on building age.

- Add cess charges for amenities like parking or hoardings.

Example:

For a commercial complex of 5,000 sq ft in Zone A (UAV=Rs. 20 UAV = Rs.20):

- Gross Annual Value = 20 * 5,000 * 10 = Rs.10,00,000

- Depreciation (10%) = 10,00,000 * 0.10 = Rs.1,00,000

- Taxable Value = 10,00,000 - 1,00,000 = Rs.9,00,000

- Cess Charges (24%) = 9,00,000 * 0.24 = Rs.2,16,000

- Final Property Tax = 9,00,000 + 2,16,000 = Rs.11,16,000

This calculation highlights how commercial properties are taxed at higher rates due to their usage type and additional cess components.

Understanding BBMP Unit Area Value System for Property Tax

The Unit Area Value system assigns fixed rates per square foot based on zone classifications:

| Zone | Residential UAV (Rs per sqft / month) | Commercial UAV (Rs per sqft / month) |

|---|---|---|

| A | 3.50 | 20.00 |

| B | 2.50 | 15.00 |

| C | 1.80 | 10.00 |

This system ensures uniformity and transparency while accounting for location-based differences in property value.

Using the above BBMP property tax calculator simplifies tax computation for residential and commercial properties while ensuring accuracy through well-defined formulas and structured inputs. Timely payments not only help avoid penalties but also allow taxpayers to benefit from rebates.