The BBMP Property Tax Receipt is a critical document for property owners in Bengaluru, issued by the Bruhat Bengaluru Mahanagara Palike (BBMP) in Karnataka. It serves as proof of tax payment and is essential for legal, financial, and compliance purposes.

This article provides a comprehensive guide on how to download BBMP property tax receipt, check its status, and resolve common issues.

How to Download BBMP Property Tax Receipt Online

Method 1: Using the BBMP Property Tax Payment Portal without Login

The official BBMP portal offers a seamless way to download your property tax receipt. Follow these steps:

- Visit the Official Website:

- Go to bbmptax.karnataka.gov.in.

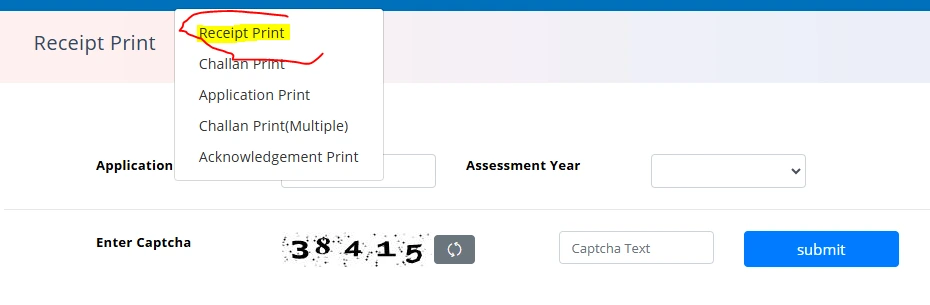

- Select Receipt Print:

- Navigate to the Downloads section

- Click on “Receipt Print.”

- Enter Required Details:

- Provide your Application Number.

- Select the relevant Assessment Year.

- Enter the Captcha Code displayed.

- Submit Information:

- Click “Submit” to retrieve your receipt.

- Download and Save:

- Once displayed, download or print the receipt for future reference.

This process ensures quick access to receipts for multiple years.

Method 2: Steps to Download BBMP Tax Receipt from bbmp.gov.in chatbot

An alternative method is through BBMP’s main website to download Your Receipt or to save a digital copy or print it for future reference.

- Visit the official website using https://bbmp.gov.in/home

- Tap on “Property Tax” available in homepage

- Click on Download Receipt and find the chatbot page

- Enter Required Details:

- Provide your Property Identification Number (PID) or 10 Digit Application Number.

- Select the relevant Assessment Year.

- Verify Captcha (if applicable): Enter the security code displayed on the page.

- Submit Information: Click on “Submit” or “Search” to retrieve your payment details.

- Download Your Receipt: Save a digital copy or print it for future reference.

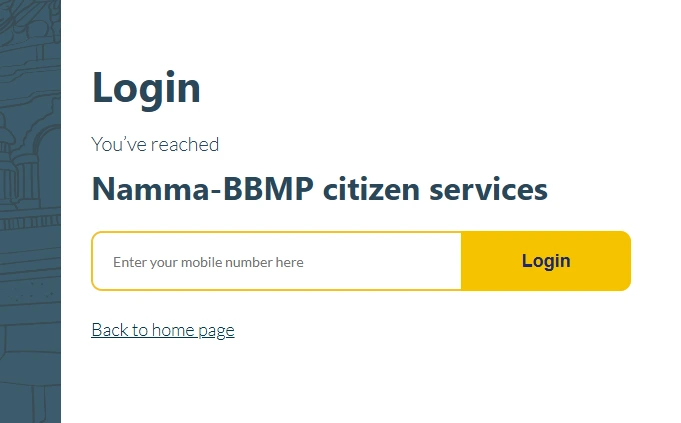

Method 3: Through BBMP Revenue Services Login

Alternatively, you can access receipts via the BBMP main website:

- Visit the BBMP Website:

- Go to bbmp.gov.in and navigate to the “Property Tax” section.

- Login/Register:

- Log in with your credentials or register if you’re a new user.

- Access ‘Tax Payment History’:

- Locate this option under “Property Tax Services.”

- Enter Property Details:

- Provide your Property Identification Number (PID) or Application Number.

- Download Receipt:

- Select the relevant year and download or print your receipt.

Importance of BBMP Property Tax Receipts

The BBMP property tax payment receipt is more than just proof of payment; it plays a significant role in various legal and financial processes:

- Proof of Payment: Confirms that taxes have been paid, avoiding penalties or disputes.

- Loan Applications: Acts as evidence of compliance when applying for loans against property.

- Property Transactions: Essential during sales or transfers to ensure no outstanding dues exist.

- Tax Filing: Helps claim deductions under income tax laws.

Maintaining these receipts ensures smooth transactions and compliance with municipal regulations.

Common Issues with BBMP Property Tax Receipt Download

Problem 1: Incorrect Details

- If you encounter errors in PID or application numbers, recheck your documents like Khata certificates or previous receipts.

Problem 2: Payment Not Reflected

- Payments may take up to 24 hours to reflect on the portal. If delays persist, contact BBMP support.

Problem 3: Technical Glitches

- Clear browser cache, switch browsers, or use incognito mode if the portal isn’t loading correctly.

Step-by-Step Guide for First-Time Users

- Register on the BBMP portal using property details like PID or Khata number.

- Log in with your credentials.

- Follow any of the methods above to download your receipt.

FAQs on BBMP Property Tax Receipts

How can I download my receipt with a PID number?

Log in to the BBMP portal, enter your PID number under “Tax Payment History,” select the year, and download it.

What should I do if my payment status shows pending?

Contact BBMP’s revenue department or use their grievance redressal system available on their website.