The BBMP Property Tax Payment is a crucial annual obligation for property owners in Bengaluru. Administered by the Bruhat Bengaluru Mahanagara Palike (BBMP), it funds essential civic infrastructure like roads, drainage, and parks.

With the introduction of the BBMP Online Payment system via the BBMP Tax Portal, paying taxes has become seamless. This guide covers everything from understanding the tax system to making payments and avoiding penalties.

What is BBMP Property Tax in Bangalore?

The Bangalore Property Tax is a levy imposed on property owners based on the Unit Area Value (UAV) System, which considers factors like location, property usage, and built-up area.

The tax is calculated annually and must be paid between April and March of the following year.

Key Features:

- Property Identification Number (PID): A unique identifier for each property in Bengaluru.

- Rebate: A 5% rebate is offered for full payments made before April 30.

- Penalty: A 2% monthly interest applies to late payments.

How to Pay BBMP Property Tax Online

The online payment process simplifies tax submission. Here’s how you can complete your payment:

To pay your BBMP property tax online, follow these easy steps:

1. Visit the BBMP Tax Portal

- Go to the official BBMP property tax website: https://bbmptax.karnataka.gov.in.

2. Enter Property Details

- Use your BBMP Property Identification Number (PID) or SAS application number.

- If you don’t have the PID, you can search by owner name and property address.

3. Verify Tax Details

- Once your property details are fetched, review the displayed information, including:

- Tax amount

- Assessment year

- Property type and usage

4. Select Payment Option

- Choose the payment method (Net Banking, UPI, Credit/Debit Card).

- Click on Proceed to Pay.

5. Complete the Payment

- Enter your payment details and confirm the transaction.

- Ensure you save or note down the transaction ID for reference.

6. Download the Tax Receipt

- After successful payment, download or print your BBMP Tax Receipt for future use.

These steps ensure a smooth and hassle-free online tax payment process through the official BBMP portal.

Steps to Pay Property Tax in Bangalore Offline

For those who prefer offline methods:

- Visit a BBMP help center or Bangalore One office.

- Provide your PID or Khata number along with previous tax receipts.

- Fill out the relevant form (Form IV for unchanged properties, Form V for modified ones).

- Complete payment via cash, cheque, or demand draft.

Check BBMP Property Tax Payment Status

To verify your payment status:

- Log in to the BBMP Tax Portal.

- Enter your PID or application number.

- View your payment history under “Payment Status.”

Download BBMP Property Tax Receipt Online

After completing payment:

- Visit the portal’s receipt section.

- Enter your assessment year and application number.

- Download and save the receipt PDF.

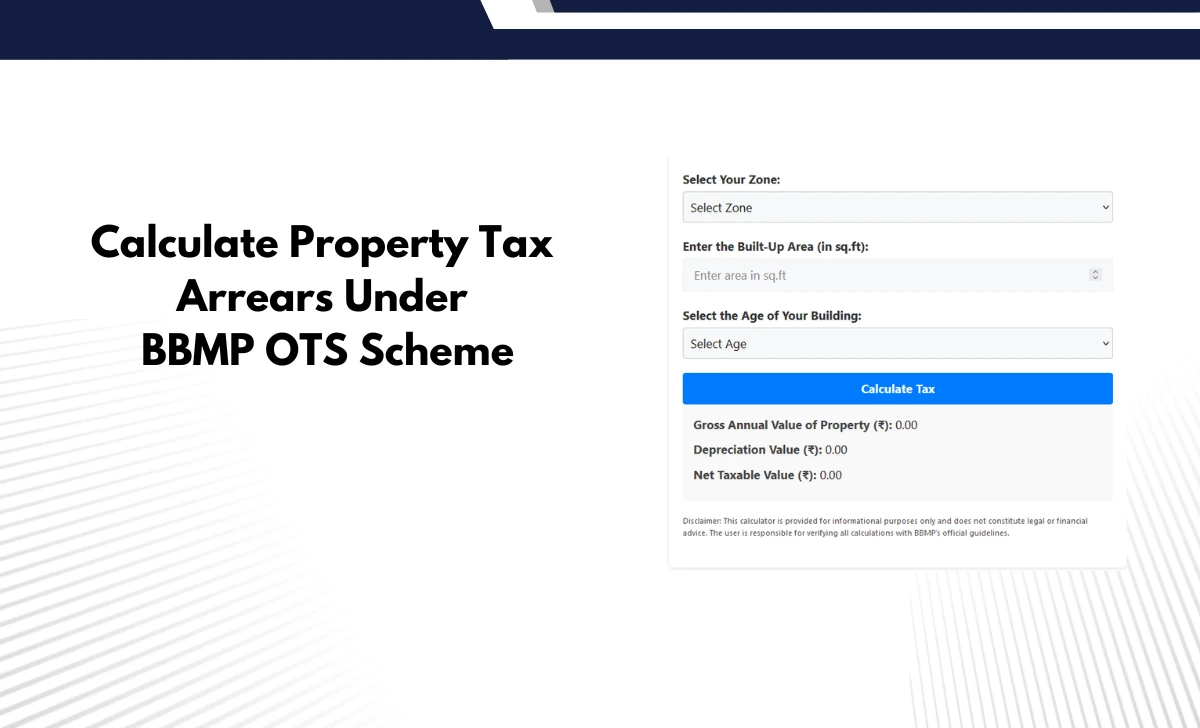

Understanding the Unit Area Value (UAV) System

The UAV system calculates tax based on:

- Property location (zones A to F).

- Built-up area (in square feet).

- Usage type (residential/commercial).

Formula:

Property Tax = (Built up Area * UAV Rate) + Cess

Cess includes education, health, and solid waste management charges.

How to Calculate BBMP Property Tax Dues

Use this formula:

Tax = (Gross Unit Area Value−Depreciation) * 20% + Cess

For example:

- Gross Unit Area Value: Rs. 2,00,000

- Depreciation: Rs. 30,000

- Cess: 24% of tax

Tax = Rs.(2,00,000 – 30,000) * 20% + Cess

Example Calculations of Bangalore Property Tax Dues

Example 1: Residential Property

Built-up area: 1,200 sq ft

UAV rate: Rs.5/sq ft/month

Tax = 1,200* Rs.5*10+Cess

Example 2: Commercial Property

Built-up area: 800 sq ft

UAV rate: Rs.12/sq ft/month

Tax = 800 * 12 * 10 + Cess

Penalty for Late Payment of BBMP Property Tax

Late payments attract:

- 2% monthly penalty on outstanding dues.

- Loss of early payment rebates.

Pay Bangalore Property Tax Using PID Number

The PID simplifies tracking and payment:

- Retrieve your PID from previous receipts or Khata certificate.

- Enter it on the BBMP portal to fetch property details.

BBMP Property Tax Refund Process for Double Payments

If you’ve paid twice by mistake:

- Submit a grievance request via the BBMP portal.

- Attach proof of double payment along with transaction IDs.

- Refunds are processed within 15 working days.

Requirements for BBMP Property Tax Payment

Keep these ready:

- PID or SAS application number

- Previous year’s tax receipt

- Khata certificate (if applicable)

Rebates and Due Dates for Bangalore Property Tax

Rebates:

- Pay before April 30 to get a 5% rebate on total dues.

Due Dates:

- Full payment deadline: April 30

- Installment option: Pay by July 31 without rebate but avoid penalties.

Online vs Offline Methods to Pay BBMP Taxes

| Feature | Online Payment | Offline Payment |

|---|---|---|

| Convenience | Accessible anytime via portal | Requires visiting centers |

| Speed | Instant processing | May take longer |

| Documentation | Digital receipts | Physical receipts |

How to Avoid Penalties on Late Payments

- Set reminders for due dates.

- Opt for online payments to ensure timely submission.

- Pay in full early to avail rebates.

By following this guide, you can efficiently manage your BBMP Property Tax Payment, avoid penalties, and contribute to Bengaluru’s development.